Advertisement

-

Published Date

January 16, 2026This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

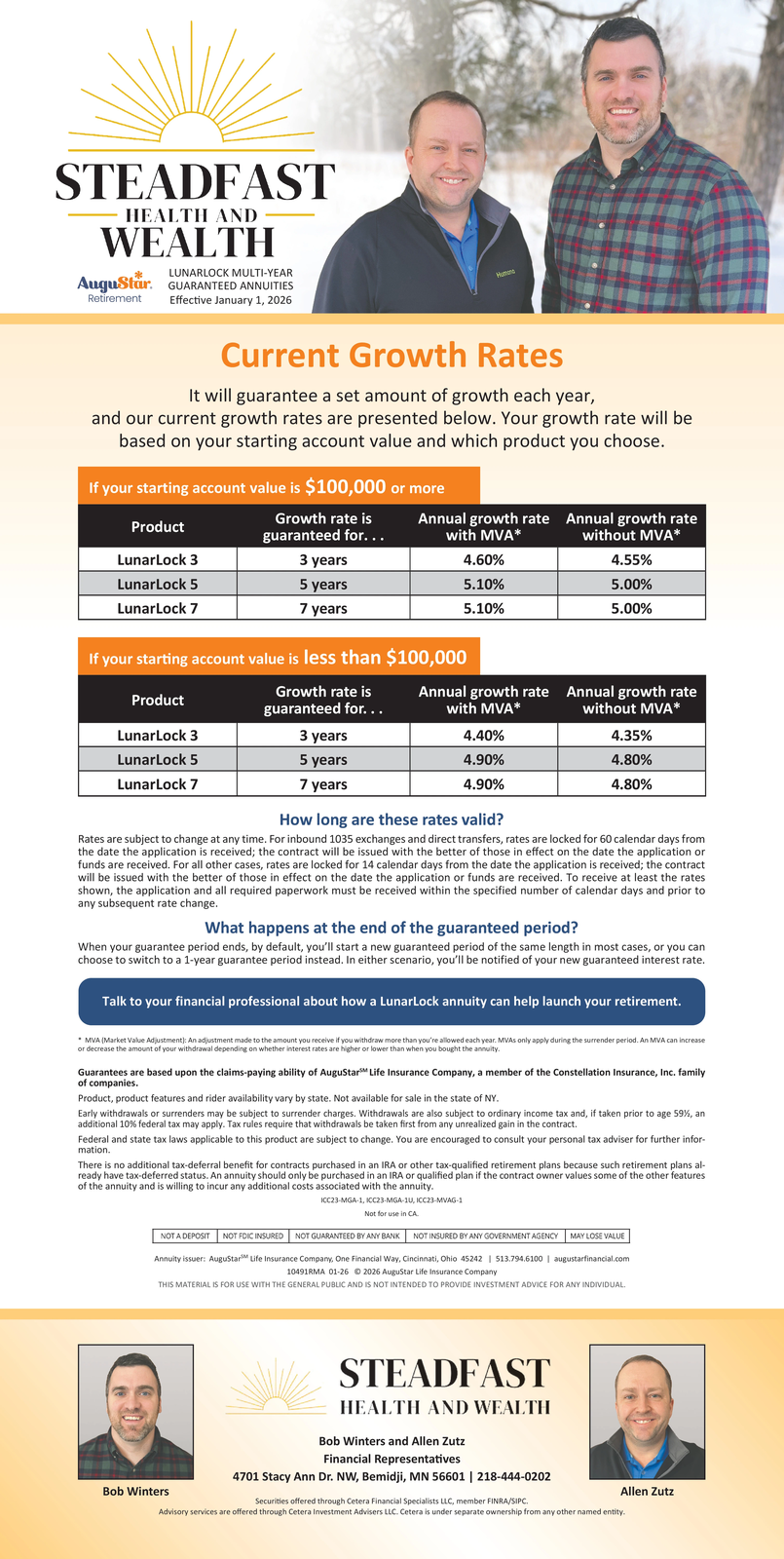

STEADFAST HEALTH AND WEALTH LUNARLOCK MULTI-YEAR AuguStar GUARANTEED ANNUITIES Retirement Effective January 1, 2026 Current Growth Rates It will guarantee a set amount of growth each year, and our current growth rates are presented below. Your growth rate will be based on your starting account value and which product you choose. If your starting account value is $100,000 or more Growth rate is guaranteed for... Product LunarLock 3 3 years LunarLock 5 5 years LunarLock 7 7 years Annual growth rate Annual growth rate with MVA* without MVA* 4.60% 4.55% 5.10% 5.00% 5.10% 5.00% If your starting account value is less than $100,000 Product Growth rate is guaranteed for... Annual growth rate Annual growth rate with MVA* without MVA* LunarLock 3 3 years 4.40% 4.35% LunarLock 5 5 years 4.90% LunarLock 7 7 years 4.90% 4.80% 4.80% How long are these rates valid? Rates are subject to change at any time. For inbound 1035 exchanges and direct transfers, rates are locked for 60 calendar days from the date the application is received; the contract will be issued with the better of those in effect on the date the application or funds are received. For all other cases, rates are locked for 14 calendar days from the date the application is received; the contract will be issued with the better of those in effect on the date the application or funds are received. To receive at least the rates shown, the application and all required paperwork must be received within the specified number of calendar days and prior to any subsequent rate change. What happens at the end of the guaranteed period? When your guarantee period ends, by default, you'll start a new guaranteed period of the same length in most cases, or you can choose to switch to a 1-year guarantee period instead. In either scenario, you'll be notified of your new guaranteed interest rate. Talk to your financial professional about how a LunarLock annuity can help launch your retirement. *MVA (Market Value Adjustment): An adjustment made to the amount you receive if you withdraw more than you're allowed each year. MVAs only apply during the surrender period. An MVA can increase or decrease the amount of your withdrawal depending on whether interest rates are higher or lower than when you bought the annuity. Guarantees are based upon the claims-paying ability of AuguStar Life Insurance Company, a member of the Constellation Insurance, Inc. family of companies. Product, product features and rider availability vary by state. Not available for sale in the state of NY. Early withdrawals or surrenders may be subject to surrender charges. Withdrawals are also subject to ordinary income tax and, if taken prior to age 59%, an additional 10% federal tax may apply. Tax rules require that withdrawals be taken first from any unrealized gain in the contract. Federal and state tax laws applicable to this product are subject to change. You are encouraged to consult your personal tax adviser for further infor- mation. There is no additional tax-deferral benefit for contracts purchased in an IRA or other tax-qualified retirement plans because such retirement plans al- ready have tax-deferred status. An annuity should only be purchased in an IRA or qualified plan if the contract owner values some of the other features of the annuity and is willing to incur any additional costs associated with the annuity. ICC23-MGA-1, ICC23-MGA-1U, ICC23-MVAG-1 Not for use in CA. NOT A DEPOSIT NOT FDIC INSURED | NOT GUARANTEED BY ANY BANKNOT INSURED BY ANY GOVERNMENT AGENCY MAY LOSE VALUE Annuity issuer: Augustar Life Insurance Company, One Financial Way, Cincinnati, Ohio 45242 | 513.794.6100 | augustarfinancial.com 10491RMA 01-26 2026 AuguStar Life Insurance Company THIS MATERIAL IS FOR USE WITH THE GENERAL PUBLIC AND IS NOT INTENDED TO PROVIDE INVESTMENT ADVICE FOR ANY INDIVIDUAL. STEADFAST HEALTH AND WEALTH Bob Winters and Allen Zutz Financial Representatives 4701 Stacy Ann Dr. NW, Bemidji, MN 56601 | 218-444-0202 Securities offered through Cetera Financial Specialists LLC, member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Cetera is under separate ownership from any other named entity. Bob Winters Allen Zutz STEADFAST HEALTH AND WEALTH LUNARLOCK MULTI - YEAR AuguStar GUARANTEED ANNUITIES Retirement Effective January 1 , 2026 Current Growth Rates It will guarantee a set amount of growth each year , and our current growth rates are presented below . Your growth rate will be based on your starting account value and which product you choose . If your starting account value is $ 100,000 or more Growth rate is guaranteed for ... Product LunarLock 3 3 years LunarLock 5 5 years LunarLock 7 7 years Annual growth rate Annual growth rate with MVA * without MVA * 4.60 % 4.55 % 5.10 % 5.00 % 5.10 % 5.00 % If your starting account value is less than $ 100,000 Product Growth rate is guaranteed for ... Annual growth rate Annual growth rate with MVA * without MVA * LunarLock 3 3 years 4.40 % 4.35 % LunarLock 5 5 years 4.90 % LunarLock 7 7 years 4.90 % 4.80 % 4.80 % How long are these rates valid ? Rates are subject to change at any time . For inbound 1035 exchanges and direct transfers , rates are locked for 60 calendar days from the date the application is received ; the contract will be issued with the better of those in effect on the date the application or funds are received . For all other cases , rates are locked for 14 calendar days from the date the application is received ; the contract will be issued with the better of those in effect on the date the application or funds are received . To receive at least the rates shown , the application and all required paperwork must be received within the specified number of calendar days and prior to any subsequent rate change . What happens at the end of the guaranteed period ? When your guarantee period ends , by default , you'll start a new guaranteed period of the same length in most cases , or you can choose to switch to a 1 - year guarantee period instead . In either scenario , you'll be notified of your new guaranteed interest rate . Talk to your financial professional about how a LunarLock annuity can help launch your retirement . * MVA ( Market Value Adjustment ) : An adjustment made to the amount you receive if you withdraw more than you're allowed each year . MVAs only apply during the surrender period . An MVA can increase or decrease the amount of your withdrawal depending on whether interest rates are higher or lower than when you bought the annuity . Guarantees are based upon the claims - paying ability of AuguStar Life Insurance Company , a member of the Constellation Insurance , Inc. family of companies . Product , product features and rider availability vary by state . Not available for sale in the state of NY . Early withdrawals or surrenders may be subject to surrender charges . Withdrawals are also subject to ordinary income tax and , if taken prior to age 59 % , an additional 10 % federal tax may apply . Tax rules require that withdrawals be taken first from any unrealized gain in the contract . Federal and state tax laws applicable to this product are subject to change . You are encouraged to consult your personal tax adviser for further infor- mation . There is no additional tax - deferral benefit for contracts purchased in an IRA or other tax - qualified retirement plans because such retirement plans al- ready have tax - deferred status . An annuity should only be purchased in an IRA or qualified plan if the contract owner values some of the other features of the annuity and is willing to incur any additional costs associated with the annuity . ICC23 - MGA - 1 , ICC23 - MGA - 1U , ICC23 - MVAG - 1 Not for use in CA. NOT A DEPOSIT NOT FDIC INSURED | NOT GUARANTEED BY ANY BANKNOT INSURED BY ANY GOVERNMENT AGENCY MAY LOSE VALUE Annuity issuer : Augustar Life Insurance Company , One Financial Way , Cincinnati , Ohio 45242 | 513.794.6100 | augustarfinancial.com 10491RMA 01-26 2026 AuguStar Life Insurance Company THIS MATERIAL IS FOR USE WITH THE GENERAL PUBLIC AND IS NOT INTENDED TO PROVIDE INVESTMENT ADVICE FOR ANY INDIVIDUAL . STEADFAST HEALTH AND WEALTH Bob Winters and Allen Zutz Financial Representatives 4701 Stacy Ann Dr. NW , Bemidji , MN 56601 | 218-444-0202 Securities offered through Cetera Financial Specialists LLC , member FINRA / SIPC . Advisory services are offered through Cetera Investment Advisers LLC . Cetera is under separate ownership from any other named entity . Bob Winters Allen Zutz